Tim Whybourne

October 6, 2022

My youngest son recently had to get his tonsils out after months of infections and sleepless nights, it was the only option. As I lay in the hospital with him the night of the day of the surgery, with the constant beeping of medical machines around me, a 4-year-old boy that had been sleeping all day, so had very little interest at sleeping more at 2am, and the constant disruption of the nurses coming in to check on the patient, the thought popped into my head that this night would never end. But the sun did come up the next day and as I write this note nearly two weeks after the operation, we have a very happy boy at home with a new lease on life after the removal of the obstruction in his throat.

This is not unlike what is going on in the market now. Just as my sons’ tonsils had to come out, the market needed to clear itself of frothy valuations and excess. And just like my son, the market will recover, and it will be stronger and healthier for it.

If you watch the news any given day, I’m sure you would agree that world events are pretty negative at the moment. If you look at Europe you see inflation rapidly accelerating, gas pipelines being sabotaged and a war between Russia & Ukraine. If you look to Asia, in China you see an entire country still battling to control covid under a zero Covid policy and in North Korea you see a nation aggressively firing ballistic missiles over Japan.

If you look to America, you see a USD (US dollar) spiralling higher and higher which should be crippling the economy and a federal reserve determined to stamp out inflation with super aggressive rate hikes.

In our own backyard we have seen our mortgage repayments increase to levels we have not seen for decades, the price of a single head of lettuce increase (and thankfully now decreased) to three times its normal value and the price to fill your car has nearly doubled. To top this all off when you look at your investment portfolios, almost every type of asset is in the red, with the exception of private assets that potentially haven’t been revalued, or hedge funds that benefit from short positions.

However, this does not feel like a recession or tougher times yet because we still have our jobs. It is hard to believe that this has been the worst year on record for bonds (which are supposed to be at the safe end of the spectrum) and the worst year since 1936 for the standard 60/40 investment strategy.

The 60/40 portfolio is probably the most common strategy to manage long term wealth for the average investor. The strategy involves, as it suggests, simply investing 60% of your money in stocks and 40% of your money in bonds. In any other market one side would often balance out the other and significantly reduce volatility over a market cycle whilst delivering around 10% pa on average per year. This portfolio has been tried and tested over several decades without issue.

However, this year, that same portfolio is down -19.4% which is actually worse than what the S&P500 index has done over the same period (-16%).

This should never happen!

What surprised most is that it has been what was supposed to be the safe side of the ledger (bonds) that are down over 20%, exceeding the loss in equities when it should have cushioned it (granted if you held these to their maturity you would get your money back). I don’t think there will be any surprise to hear that this is not a normal market at all (Source: CNBC, This classic investment strategy is on track for its worst year ever, Oct 3, 2022).

For a few of you reading this, perhaps it is the first bear market you have experienced. The good news is that history is on our side, and historically speaking, what we know is that type of environment will not last forever. The markets job is to try to predict, or price the future, and do not represent the present. Markets should be well on their way to a recovery before the economy itself starts to recover.

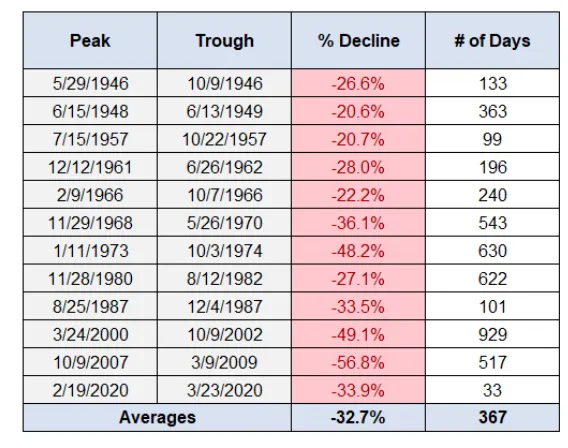

I borrowed the below chart from one of my favourite blogs, A Wealth of Common Sense. The chart shows all the bear markets since World War II and how long the market took to recover. You will note that the largest drawdown was 48.2% and the longest amount of time for that market to recover was 929 days or a little under 3 years. You will also note that the average draw down was 32% which we are not far off now from the November 2021 highs.

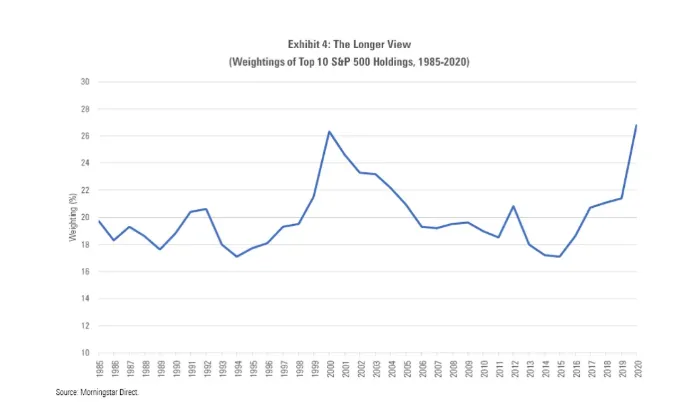

An important thing to consider here is that this is purely the S&P500 only, and results should be more conservative for a diverse portfolio. The other thing to note is that the S&P500 has become highly concentrated compared to its historical average with the top 10 stocks representing 30% of the index value. So, I do think we need to take this comparison with a grain of salt as we are not comparing apples with apples.

If you look at the Nasdaq, it has fallen more than 30% from its top with some of its constituents falling more than 70% so my point is that I believe many stocks outside of the top 10 in the S&P500 have well and truly bottomed and have already begun their recovery.

The chart above shows the concentration of the S&P500 over time. You can see here that we are at record levels of concentration.

In forming our views on markets, we will always try to take in a diverse range of opinions, particularly if they challenge that of our own.

One of the more recent bearish commentators I could find is Morgan Stanley’s Mike Wilson. Mike always presents a balanced view of the world, but in a recent interview told CNBC’s squawk box that the S&P500 could fall below 3000 which would represent a circa 20% further fall from current levels. He told the audience that “we are in a cyclical downturn for growth and that this is the fire and ice narrative to a tee, the tightening policy and the slowing growth… and were just not finished yet”.

This is however their bear (worst) case scenario with their base case representing only a circa 10% downside from here. He did finish the interview with a glimmer of optimism saying “we are getting close to the end.. the damage has been done .. now we are actually getting ready to be more aggressive, it’s just not the time yet, in our view and to be premature can be quite costly”. (Source: CNBC Interview: The Morgan Stanley strategist called the bear market says the S&P could fall to low 3000.)

One of the more positive economic commentators is Citibank’s Scott Chronert predicting that earnings will be resilient in the quarter through to Christmas. They say that given the poor sentiment in the markets; they expect a rally in the fourth quarter for the broader market to hit the firm’s 4200 year-end target putting the risk of a severe recession at 5%. (Source: Citi’s top stock strategists expects a market risk-on rally in the fourth quarter, 29/9/2022)

Notorious technology investor, Cathie Wood from Ark Invest’ view was also quite contrarian to the market in a recent interview with CNBC. She told the audience that we are already in a recession and that the only reason the USD has been so strong is that the USD is a flight to safety currency. She is seeing an enormous amount of demand destruction citing oil as an example which has slumped to its lowest level of demand since 1997 (25-year lows).

She spoke about how they believe core inflation (PCE inflation) has already peaked at 5.3% (now down to 4.6%) but the main type of inflation that is being quoted in the media and referenced by the fed is the CPI which is still sitting around 8.25%.

The significant difference between the two measures it that PCE measures data from gross domestic product and suppliers but the CPI only accounts for all urban households, you could argue that PCE is more relevant measure, but the Fed does not take it into account.

Ark argues that the inflation rate and unemployment rate are both lagging indicators of how the economy is performing (she is right on this one as we learn that in basic economics). What they should be looking at are leading indicators to work out where inflation is heading not where it has been, according to Cathie, the leading indicators are all pointing towards deflation. This sentiment was also mirrored in the “All-In Podcast” on the weekend with the four contributors agreeing that the Fed should be looking at more forward-looking data not backward.

Cathie believes that with all the price declines we are seeing in retail and the fall in commodity prices we will soon see that inflation will be surprisingly low. They would not be surprised to see month on month deflation for several months over the next 6 months. This leads them to believe that the Fed has overstepped and will have to pivot and reduce rates sometime next year which would be positive for equity and other risk markets. It was interesting to see our own RBA (Reserve Bank) surprise to the downside on their recent rate rise of 25bps v the expected 50bps… do they know something we do not?

Finally, ARK believes that there is so much bearishness out there at the moment (Goldman Sachs and Blackrock have both recently downgraded their outlooks for equities among others) that it reminds Cathy of the 1982 business week front cover titled “equities are dead”.

Do you know what happened in 1982?

After a prolonged period of inflation and falling equity markets, the market had finally bottomed on August 12 representing a 27.11% fall from the top. It then took a mere 83 days to recover its high. The cause of this sell off was inflation hitting a rate of 13.58% (commonly referred to as Volker’s Bear).

This chart shows what happened to the market in 1982 and iterates the point that it was better to be in the market a year too early than a month too late (source: Forbes: Volkers Bear: the bear market of 1982)

UBS shares a similar view writing in their monthly letter to investors that “once investors gain confidence… the rebound is likely to be fast, our base case is that markets will be higher by June 2023”. They do say however that the remainder of the year will be volatile and are selective in their exposures, favouring defensives, income, value, and diversification.

UBS believes that inflation will continue to persist, and the Fed will continue to raise rates potentially another 1%-1.25% which will result in them taming inflation and being able to pause by early 2023. Anecdotally they mentioned that the ratio of bulls to bears is currently more than two standard deviations below its average which has historically been a contrarian indicator resulting in markets closing 9% higher over the coming 6 months.

The UBS bear case is that the S&P500 falls to 3300 (10% fall and a 10%-20% probability), their base case is 4200 (14% rise with a 50% probability) and their bull case is 4800 (30% upside with a 20% probability), (Source: UBS Note, Year of Discovery Continues, 24/9/2022).

I am an avid listener of “The All-In podcast”, a podcast run by hedge fund and venture capitalists, Chamath Palihapitiya, Jason Calacanis, David Sacks and David Friedberg. Chamath, successfully predicted the recent turndown and came out on the most recent issue with his new prediction that “this is the time to start nibbling and start getting ready to really rip money in, because I think the markets do a reasonably good job of digesting news and then pricing the forward reality”. “Today price is everything we already know, so the real guess is what’s about to happen in the future, from my perspective I’m starting to get a little constructive here.” (Source All-In Podcast, October 1).

Views on market direction aside, regardless of what happens over the next 6 months we would implore investors to stay invested and ride this out. There was an interesting article in the AFR over the weekend titled “Timing the Market can cost 0.5pc a year”, in my view it costs people much more on average. This is just a recent example of the same empirical evidence I have seen over several different periods and countries, but the messaging is just the same, trying to time the market will most likely cost you money.

This same phenomenon was observed by a study conducted by fidelity on Peter Lynch’s, Fidelity Magellan fund (Source Forbes: How Investors are costing themselves money). The study found that even though the strategy returned over 29% pa for 13 years the average investor in the fund lost money. This was because the average investor would sell out after a bad year thinking it would never end and buy back in after a good year thinking the superior performance would persist… the only way to get the fund return of 29% pa was to ride out the highs and lows, this is even more obvious when you consider transaction costs and taxes.

No one knows what the future will bring, and we may well see this volatility play out for months to come as these huge macro issues wash their way through the system. We will undoubtedly face new challenges also however it is important to remember where we came from. At the start of the year most major asset classes were priced for perfection, today many are discounted for disaster so when will the pendulum swing back?

Until next time,

Tim

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

The information in this podcast series is for general financial educational purposes only, should not be considered financial advice and is only intended for wholesale clients. That means the information does not consider your objectives, financial situation or needs. You should consider if the information is appropriate for you and your needs. You should always consult your trusted licensed professional adviser before making any investment decision.

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

NewsLetter

Free Download