Craig Emanuel

November 9, 2021

There are various types of risks to be managed in relation to investments. For example, market risk relates to variability in the price of an investment, such as daily share price movements. Concentration risk relates to holding a high weighting in a single investment or a single type of investment, such as bank shares. There are various other specific types of risk.

One thing we regularly say to our clients is that the word ‘risk’ itself is often misunderstood.

Personally, I wouldn’t classify risk as the chance of losing capital – as a client or an investor. I would instead, say that basic investment risk relates to your tolerance for short term volatility (price swings).

We see price changes and volatility daily but over the long-term, our view is that these are largely irrelevant to the underlying value of a good investment or the growth in the value of markets.

One area, amongst others where we can add value to clients, is educating them about taking a long term view, and not focusing on short term risks / short term volatility when it comes to making investment decisions.

When it comes to risk profiles, as financial planners, it is important for us to make sure that all of our clients meet what we like to call the classic “sleep at night test”.

After all, we as investment advisors give our clients guidance about where their money should – or more importantly – shouldn’t go. At the end of the day, we need to give our clients an investment strategy that balances their expectations, their goals, and their risk tolerance.

To start, we are taking things back to the basics and understanding that risk (as I have defined it) is strongly related to return.

Traditionally there are two groups of assets: income assets and growth assets. In this simple traditional framework, the more growth assets you want or you have as part of your portfolio you are said to be a “higher risk” investor.

The approach to risk determines the investment choices and therefore the returns for every portfolio. You can’t expect to make any return without taking on some level of risk. So, risk and return are directly correlated.

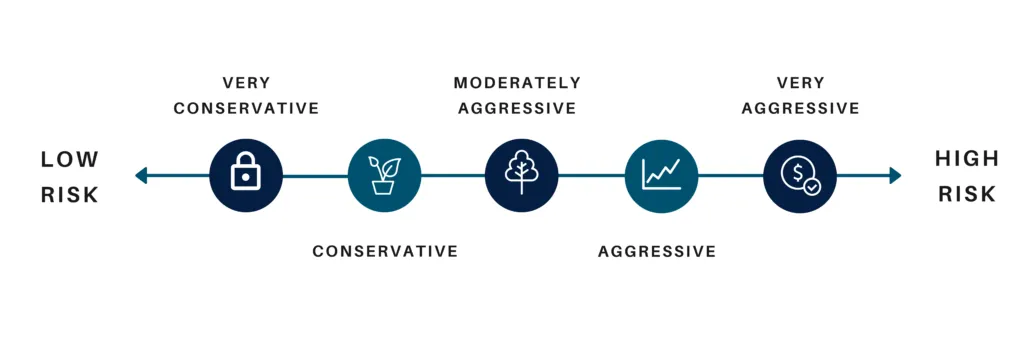

The clients at Emanuel Whybourne have varying risk profiles.

For example, some of our clients sit within the not-for-profit foundation and philanthropy categories. Typically, they are profiled as what we call conservative or “balanced” clients. This is generally because a non-profit organisation is overseen by a board, and the board has certain expectations as to how the foundation’s money may be invested and also how is spent. Non-profits and charities need to draw money at various intervals of time for gifting, granting and infrastructure for buildings. So, for them, liquidity may be very important, and they may need to have a lower risk profile.

Another risk profile is high growth where investors put much of their money in growth assets. They are willing and able to take on more risk – and in turn, receive a higher return over the long-term.

In general, Low Risk portfolios have a higher weighting to cash and fixed interest than High Risk portfolios which usually hold a lot more domestic and international share-based investments.

Some of our high growth clients are facing a difficult challenge currently given where the cash rate currently sits. The Reserve Bank of Australia Cash Rate is currently 0.10%. This historically low rate is mirrored at other central banks around the world such as in the US and Europe. The result is that the interest paid on deposits by commercial banks is also very low.

With very low interest rates, it is difficult for investors with a low risk profile to achieve the returns they want (or need).

This is especially prevalent in retiree investors. Ten years ago, a retiree could choose a simpler, lower risk investment strategy by investing in cash and fixed interest with a return in the order of 7 to 8% per annum. Given the current interest rates are near zero, it’s impossible to take on such a conservative approach and generate the same returns. This presents a challenge.

I would argue that investors (in particular retirees), are almost squeezed to make the decision to dial their risk up to chase a greater return than current low interest rates provide.

It’s very important for a financial planner to understand your risk profile, and more importantly what you expect from a performance standpoint so they can provide the right advice that will meet your investment objectives.

We have some clients in their late 80s and their risk profile is high growth and, in some cases, speculative – which is very high risk. A lot of the clients at this age with a growth-focused risk profile are very wealthy. They’ve worked very hard through their lives to generate their wealth and are still enjoying generating wealth and taking on high growth investments. In the case of most of these clients, their children are very wealthy also and they have more than sufficient wealth to pass on for generations to come.

As financial advisors, it’s not really for us to say that they shouldn’t be a high growth client. Why? Quite simply, it is their money and not ours. The right investment strategy for them will depend on their risk appetite.

On the flip side, some of our younger clients have also generated a high amount of wealth through a business exit. These clients may be in their late 30s or early 40s.

As these clients are young, most financial advisors would say that they have a high growth risk profile.

But in actual fact, every investor’s risk profile is unique and it is not always dependent on age or financial situation.

In my view, a standardised approach to determining a persons’ investment risk profile is quite wrong. It very much depends upon the approach you want to take.

As a financial adviser, when I meet with a new client, there are some basic questions we start with to determine how we can advise them on the most personalised investment strategy for their future.

The first question is: What is your Investment Horizon? In other words, how long do you expect to invest the money that you’re entrusting to our firm?

The answer to the question will usually depend on your financial situation and your goals for the future and also, sometimes your experience with investing knowing that there are advantages from long-term thinking.

Is it likely you will need access to money from your investments at some specific point down the line? Whether it be for a home upgrade, gifting to children, or buying another business?

If so, it’s always important for investors to consider having available cash or liquid assets at hand if needed.

However, in our view, cash is not an “asset” class. Cash is over the long term doomed for what is called inflation erosion – where cash will lose value in relative terms over time because of inflation in asset prices.

So it’s important for investors to segregate cash for working capital for liquidity purposes, as distinct from long term positions.

To determine your risk profile, firstly, consider your investment horizon.

We generally say to clients, if your investment horizon is under a three-year period, cash is the only option. In our view, a three-year horizon is too short a time period to invest capital given market risk.

If an investment horizon is between three to six years, this is where investors would be happy to take on some level of risk. You can begin to allocate some money across other asset classes such as:

If a client’s investment horizon is more than six years, this is considered long term. This is where a trusted financial adviser can guide clients into being comfortable to take on growth, or high growth assets or risk. That ensures that over the longer term, clients will be generating higher returns than would have been generated from very conservative assets.

As an investor, you can’t expect to make some level of return without taking on a level of risk.

The higher the risk (or in other words, the higher short term price volatility), the higher the expected return you will generate over a longer term.

About five years ago, I was invited to attend a dinner at a large national industry award event in Sydney. I had the opportunity to sit down and have dinner with two of America’s highest-profile, most highly awarded Investment Advisors.

The sheer amount of wealth that American advisors manage in the U.S. compared to Australia is quite incredible. I had the opportunity to have a couple of drinks with an investment advisor named Jeff who, at the time, was employed by Merrill Lynch in New York.

In order for you to have ‘face time’ and become a client with Jeff, you had to have a minimum investment portfolio of U.S. $500 million. Now, the first question I asked Jeff was “What’s the best book you’ve ever read?”

His answer? Behavioural Investment Counselling.

Jeff then followed up with “But you won’t be able to find it. It’s been out of print for 20 years.”

But I was eager. So, the following morning, I Googled the book and found three old tattered copies on eBay. They weren’t cheap but I bought them all – about U.S. $200 a copy. I’ve since reached out to the author of the book. His name is Nick Murray and he’s still alive at 92 years of age. We actually converse on email quite regularly. Nick originally was the guy that founded the New York Financial Planning Association.

The book is very simple, and it simply breaks down the expected return of all asset classes an investor can invest in. The most valuable thing I learned from reading the book was this…

No one can predict the future returns of any asset class, but the easiest approximation is to look at historical returns.

What is commonly overlooked is the “real” (inflation-adjusted) return on those asset classes. By the time we reduce these returns by the inflation rate (2-3% per annum), the extra return generated by the global share market is quite incredible.

Why does the global share market offer you the greatest return of every other choice out there?

In some ways it is the scariest investment. Over a 10 year period, an investment portfolio exposed to 100% international shares can be in the red (lose money) for more than 3.5 years out of 10.

That is why it offers the greatest return of every asset class.

So, in my view, one of the biggest values we can add to our clients is to explain that risk is observable mostly over the short-term and they be comfortable in allocating as much of their portfolio as possible to the highest returning asset class as they can. Next, our tip is to not watch it, don’t log on and watch your daily market movements. Buy a portfolio and put it in the bottom drawer (so to speak).

It is my view that investors shouldn’t specifically change their portfolio or asset mix just because they are retired.

Two-thirds of the money we manage for our clients is sitting within a self-managed super fund (SMSF). If you have retired from work, and are no longer receiving an income, this doesn’t necessarily mean your risk profile needs to change.

We do however emphasise the crucial importance of our clients’ super funds and contributions. At Emanuel Whybourne, we always put a very high focus and on holding every one of our clients’ hands throughout their lifetime to maximise their superannuation limits as best as they can. We often recommend pushing as much capital into your super fund every year throughout your entire investing lifetime.

This is because of the tax advantages of superannuation.

In time your super fund will replace the income from your employer or replace your business and possibly become either your sole source of income – or your primary source for the remainder of your life.

When people retire, it’s easy to think that everything needs to change – including your investments. However, just because you retire, it may not be optimal for you to become more conservative with your investments. The average life expectancy in Australia for a male is 84 years of age. If you’re female, you can expect to live longer to around 87 to 88 years of age. However, life expectancy is an average. Some people live much longer than the average.

So, if we assume that a person retires at the age of 65, their super fund is a long term, two to three-decade portfolio. That is very long term money. Simply because you’re retired, doesn’t mean you have to take less risk with your investments. I would probably say in a lot of cases, the reverse might apply.

What should you invest in during retirement?

Asset allocation is something all investors should take very seriously. At Emanuel Whybourne, we run a weekly investment committee process – both internal and external.

Within our firm we have three partners; all of us carry different life experiences, all of us are different ages, and all of us can think very differently. So, often after considerable debate taking all the viewpoints into account, it’s important for our firm’s Investment Committee to arrive at a consensus.

KEY TAKEAWAYS

It’s the most important thing for us as financial planners when partnering with an investor (or a family) to fully understand what your expectations are for your money and your investments – the money that we are hoping to manage. We take this role very seriously for every client.

If you’re looking to invest in line with your personal risk tolerance, our investment advisers can support you. If you are seeking higher long-term returns through a customised strategy, or a more personalised investment portfolio for your future, reach out to us.

Until next time,

Craig

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

The information in this podcast series is for general financial educational purposes only, should not be considered financial advice and is only intended for wholesale clients. That means the information does not consider your objectives, financial situation or needs. You should consider if the information is appropriate for you and your needs. You should always consult your trusted licensed professional adviser before making any investment decision.

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

NewsLetter

Free Download