Ryan Loehr

January 28, 2022

I have always thought that the very best athletes are the ones with a game plan. They outsmart their competition. They know how to compete on their terms, play to their strengths and exploit their opponent’s weaknesses.

Famously, Muhammad Ali’s ‘Rumble in the Jungle’ match against heavyweight champion George Foreman was a good example of this. The match has been called “…the greatest sporting event of the 20th Century” finishing with a major upset as Ali won against a heavy-hitting Foreman, despite coming in as a 4-1 underdog.

Foreman clearly had the greater strength. He was 7 years younger than Ali and threw the most punches. But Ali outwitted him. He switched from his typical duck-and-weave to a strategy dubbed the ‘rope-a-dope.’ This involved leaning on the rope and allowing Foreman to punch his arms and body but forcing Foreman to expel his energy in the process.

By the seventh round, Foreman was physically exhausted, allowing Ali to finish him with a flurry of punches and knocking him to the canvas.

To the audience, many may have believed Foreman was in control. Yet, to Ali, his coach and his team, they had a game plan that led to the desired outcome.

Similarly, from an investment perspective, it’s easy to be reactive to headlines. It’s easy to want to throw punches or take action by trading in any out of positions in hope of achieving a better outcome. Yet, this can also come at a cost.

Investors seemingly face a new opponent in 2022 – Inflation.

US Inflation is the highest it has been in 13 years, with December’s year-on-year reading at 7.0%.

One of the potential issues stemming from high inflation can be interest rate rises. Central banks often act to increase interest rates to cool the economy and prevent asset prices from accelerating too quickly. If central banks fail to act, particularly when credit is so readily available and cheap, it can result in excessive risk-taking and a build-up of leverage among businesses and households.

However, if Central banks act too early, it can push the economy into a recession because the cost of servicing debt, investing in new projects, or making longer-term financial decisions can become more costly.

Higher rates, also devalue future cashflows; which is why ‘growth’ stocks can fall.

As so often occurs in market headlines, commentary about inflation is seemingly in hyperbole.

Minutes released by the Federal Reserve last week gave clarity to its tone. It is likely that:

In December, the Fed committed to reducing Treasury purchases by $20B, and agency MBS by $10B, which started in January. Similar reductions will occur in February and March, ending QE by March.

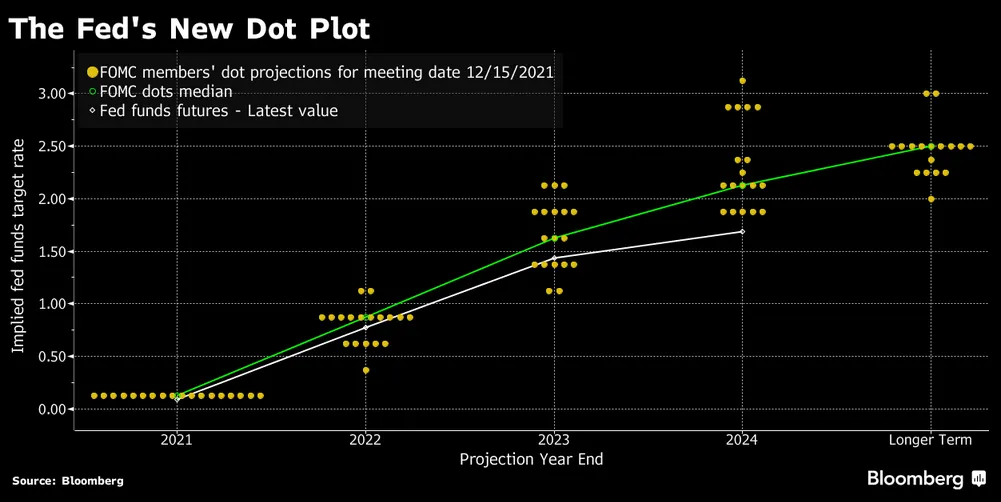

What we are seeing here is normalisation. It is ending its asset purchase program, which was a stopgap measure to support the economy during the pandemic. Similarly, interest hike expectations (outlined in the chart below), suggest we could see four interest-rate hikes in 2022, taking the cash rate to c. 1.00% by year-end. For comparison, this rate was in a range of 1.50% – 1.75% prior to the onset of the pandemic. At 1.00%, adjusted for inflation the cash rate remains extremely accommodative, and in most cases, negative.

By the end of 2022, inflation is expected to fall to 3%, which still means the real cash rate will be negative 2.00%. Therefore, the reaction we have seen in markets over the past two weeks may reflect market surprise to a more aggressive rate-hike path and withdrawal of stimulus; however, we are very far from dramatic hyperinflation episodes of the 1970s and 1980s.

I wrote about inflation several times throughout 2021, with prices in housing, listed assets, materials and labour all increasing significantly from their lows of the previous year.

I expressed my opinion that above-trend inflation was a result of Covid-related events and measures, such as supply-bottlenecks, the reorganisation of labour as countries and their economies normalise from the pandemic, government support-payments and pent-up household savings, as well as inflation numbers reflecting a lower base, given the year-on-year data was distorted by lower 2020 readings.

In recent weeks, Fed Chairman Jerome Powell confirmed these thoughts, noting: ‘Inflation is at a near-40 year high of 7% not because of a hot labour market and rising wages, but because of product shortages caused by supply-chain disruptions and stronger demand that resulted from aggressive stimulus.’

This is an important distinction to make. Inflation is rising predominantly because of supply-side disruptions. As an example, China’s zero-Covid strategy has resulted in harsh lockdown measures, preventing manufacturers to produce at normal capacity. Japan’s Toyota and Germany’s Volkswagen have both suspended factory output, and Samsung closed its factory.[1]

Many operating models used by companies focused on lean manufacturing, ordering parts only as needed, and reduced cost by moving production to low-wage environments. What we have seen are companies revisiting this policy, ordering ahead, diversifying production, and changing their supply chain to add resilience.

The reason this distinction is important is that Federal Reserve and Central Bank policy cannot address the fundamental issue, which is supply-side disruptions. Higher rates might curtail some appetite for borrowing and therefore, aggregate demand, but this could be a mistake.

Until then, lifting rates adds to already higher cost to businesses, which are absorbing more expensive inputs in the form of materials and labour. This flows back to the consumer in the form of job loss.

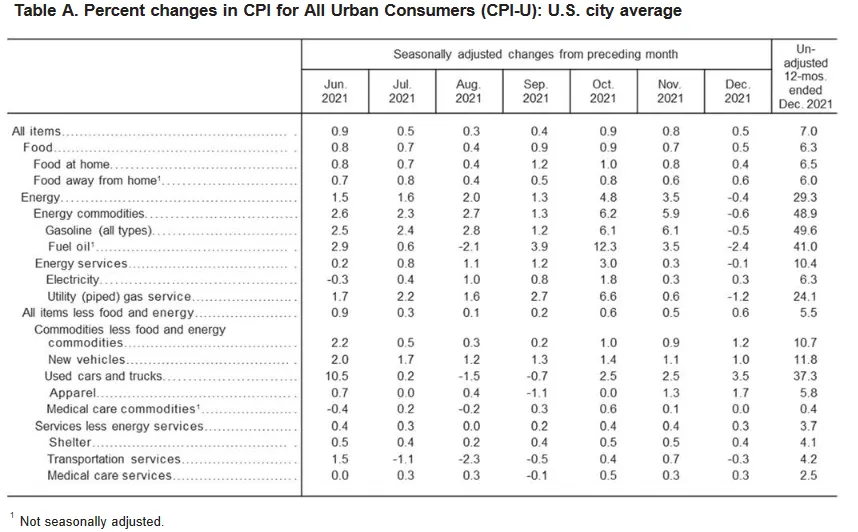

The headline, US December-end inflation figure also appears distorted. The below screen capture reflects the YoY price rises in the US Consumer Price Index (CPI), a measure of inflation.

What you can see is that much of the 12-month price change is driven by two categories:

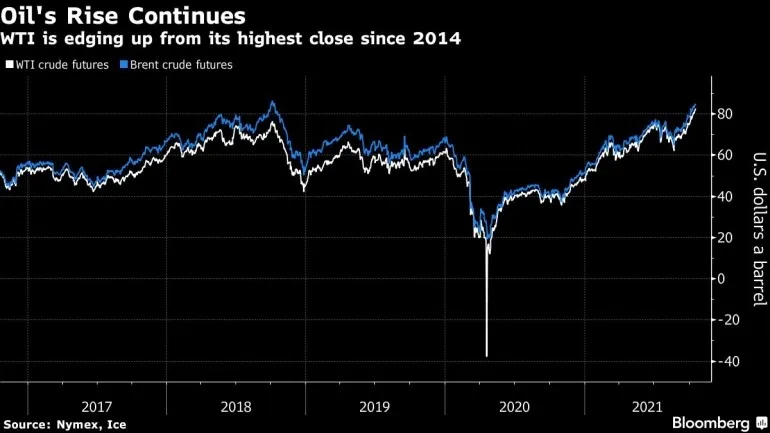

Many of you will recall that Oil was trading negatively in April 2020 – the only time this has occurred in history as demand reduced and transportation and storage costs increased. Prior to the pandemic, WTI and Brent crude futures, which track the price of oil, was trading steadily around $60-70/barrel.

New investments in oil and gas production have declined because of the 2020 price collapse, but also that in 2014-15 (the OPEC price war). Long-term investors have favoured investment cut back for dividends, in turn making supply more vulnerable to the types of circumstances that we see today.

In April 2020, the same month as oil traded negative, new vehicle production dropped 99% from prior months in the US alone. For the full year, it is estimated that new vehicle production reduced by 20.39% relative to 2019.[2]

This was driven by a demand shock, as lockdown forced people to work from home or isolate, causing auto production to halt. Then an ensuing supply shock as factories had to compete for key parts as production resumed, particularly semiconductors. Given the shortfall in new vehicle supply, it increased demand for the used car market, lifting prices.

My point in the above two examples is that inflation is being skewed by lower base levels of 2020. However, of the underlying inflation that does exist, this is a result of supply chain reorganisation.

We have begun to see companies reorganise supply chains, in some cases as a matter of national security. The pandemic revealed how factory shutdowns and shipping disruptions can impact industries such as defence, technology, energy, transport, public health, and biological sectors.

This is causing businesses and government to prioritise local manufacturing, which could create a great ‘reshoring’ transition. One example of this was US legislators introducing the CHIPS for America Act, which will provide up to US$52B in subsidies for onshoring semiconductor manufacturing and see technology companies invest billions to establishing US-based fabrication facilities.

Other recent announcements include:[3]

Intel has invested $20 billion in two leading manufacturing facilities in Arizona. It has also announced plans to invest $60-$100 billion over 10 years at a new hub within the US.[4]

Greater ‘reshoring ‘is likely to result in continued higher costs as businesses employ a local workforce instead of low-cost labour, invest in local manufacturing and reconsider how it manages product transportation. At scale, this will likely drive inflation and in particular, wage growth. It is excellent for the domestic economies of these regions as jobs and spending is brought back home.

A greater number of companies are also investing in vertical integration, by acquiring businesses that sit within their supply chain.

Think of Apple outsourcing the manufacture of computer chips for their iPhones or MacBook’s to a third party, but then acquiring it to have certainty over the production. We anticipate substantial, continued vertical integration.

Regarding wage growth, it is worth mentioning this briefly. US wages ended 2021 higher with a 4.70% increase for the year and unemployment fell to 3.90% from 4.20%.

Yet the highest wage growth has come from leisure and hospitality, retail, services and education – all ‘in person’ industries that had a materially lower base from pandemic restrictions.[5] And while wages have been growing, the total number of employees in the US is still lower than before the pandemic, with 3.6M fewer positions.

This is reflected by a lower participation rate of 63.40%, leaving ample room for workers to return to the workforce once the effect of stimulus cheques and pent-up savings subside. Notably, wage growth at 4.20% is still substantially less than underlying inflation, so we don’t have real (after-inflation) wage growth yet. Increasing cash rates now, could in turn, increase the cost of business servicing debt, deterring reshoring or big-ticket purchases that create jobs in the first place.

To summarise – markets are currently reacting to high headline inflation readings, specifically that of the United States December-end CPI of 7%. This figure is skewed, mostly by energy and vehicle prices, which have accelerated from very low, even negative, levels of 2020. Concerns about inflation hide the more important topic, which is the reorganisation of global supply-chains.

Localising manufacturing will come at significant costs, both in capital and labour; and it seems illogical that the Federal Reserve would want to disincentivise this by aggressively hiking interest rates now. This is particularly so, given that said investment is of strategic importance to the United States. Additionally, commentators will have you believe that a rotation from technology, or ‘growth’ stocks into old industry, ‘value ‘businesses will occur because of rising inflation.

However, many of these ‘value’ businesses are ironically the ones that would be most shocked by rate rises, given they are usually more capital and labour intensive, or are often those faced with significant supply-chain issues, requiring enormous investment into reorganising production.

Just like Ali vs. Foreman’s ‘Rumble in the Jungle’, it may feel like markets are taking a few punches to the body, but volatility will tire out the traders and speculators.

‘Value’ businesses will likely see a knockout punch, losing to companies that have better control over their supply chain, are agile and innovate, sell software or services (instead of physical goods) and have reliable consumers.

Investors who stick to their long-term investment horizon will be rewarded, while traders and speculators won’t.

All client portfolios with EW Wealth are filled with a high quality, diversified asset base. Volatility is a friend, not a foe – it’s also the reason equities reward investors with higher returns.

Until next time,

Ryan.

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

The information in this podcast series is for general financial educational purposes only, should not be considered financial advice and is only intended for wholesale clients. That means the information does not consider your objectives, financial situation or needs. You should consider if the information is appropriate for you and your needs. You should always consult your trusted licensed professional adviser before making any investment decision.

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

NewsLetter

Free Download