Ryan Loehr

October 11, 2021

We are in the middle of a new build in Sanctuary Cove, currently. Whenever we have been in the market for a new property, or a new build, it seems a good prompt to reflect on what the market is doing and lately, home prices seem to be skyrocketing. Take your pick of some desirable property location and prices are up more than 20 percent year to date in most cases. Like any run in asset prices, this seems to encourage fear of missing out (FOMO). The belief that because prices have risen by such a level already, they might continue to rise and delaying a purchase could see investors miss out.

# SuburbRegionMedian house price in May 2021Change in median house price (12 months to May 2021)

Byron Bay, NSW

Richmond – Tweed

$2,700,000

$1,286,000

Northbridge, NSW

Sydney – North Sydney and Hornsby

$4,070,000

$1,040,000

Palm Beach, NSW

Sydney – Northern Beaches

$4,325,000

$965,000

Bronte, NSW

Sydney – Eastern Suburbs

$4,340,000

$890,000

Killara, NSW

Sydney – North Sydney and Hornsby

$3,605,000

$887,500

Seaforth, NSW

Sydney – Northern Beaches

$3,250,000

$880,000

Burraneer, NSW

Sydney – Sutherland

$2,730,000

$807,500

East Lindfield, NSW

Sydney – North Sydney and Hornsby

$3,280,000

$730,000

Glenorie, NSW

Sydney – Baukham Hills and Hawkesbury

$1,990,000

$712,000

Mosman, NSW

Sydney – North Sydney and Hornsby

$4,400,000

$675,000

In the past 18-months, we have witnessed ‘FOMO’ in everything from speculative stocks mentioned on Reddit forums such as GameStop, or AMC; those ‘tweeted’ about by celebrities on Twitter; IPOs; Cryptocurrencies; SPACS and there has even been an exchange traded fund created in the US with the ticker ‘FOMO.’ It’s not altogether surprising that we are seeing this theme play out in property prices. Investing on the basis on FOMO is a sure way to derail your wealth, irrespective of asset class.

I would typically avoid writing a piece on the property market, but it is a recurring topic discussed with most families we meet. I have received several calls on the subject in the last week and believe it is more relevant to review property holdings now compared to at any time over the past decade.

From an advice perspective, time and time again, we find that clients (or potential clients) have significant property exposure, both directly and indirectly. It’s typical for us to see 60-80% of family wealth concentrated in a main residence, and an investment property such as rent to occupier, or a commercial premises used by their business. On top of this, we find that clients who move to our firm after using the services of another adviser were often told to invest much of their portfolios in Australian Shares, of which ~40% is denominated by Financials such as Banks and listed Real Estate trusts or developers. Banks derive most of their revenue through property lending, and so, in our view, this is another type of property exposure – albeit indirect.

As investors, we have all likely heard the phrase ‘don’t put all your eggs in one basket.’ This proverb describes concentration risk – the risk that investors are too heavily concentrated in a handful of businesses, types of assets or sectors. In this case, most Australian’s have a significant concentration risk in property. If we were to see events lead to a correction in property prices, this would have a very significant impact to household wealth. This concern is multiplied if homeowners have a significant level debt associated with their property or properties holdings. We try to mitigate these risks by diversifying client assets away from the Australian market, or the Australian property market, as many families will already have a significant asset base connected to our local economy.

The past 18-months has seen a rapid rise in property prices owing to a culmination of record low rates, unparalleled fiscal stimulus, lockdown savings, limited housing stock expectations and a limited ability to travel. In my last note, I touched on rising mortgage stress and the reality that spending on residential housing has been driven mostly by lower interest rates rather than higher incomes. Wages haven’t been growing at half the rate as borrowing.[1] Households are more indebted now than they have ever been, and total loan commitments have risen from circa $17.5B in 2020 to ~$33B in 2021. From a lending perspective, it has become common to see debt-to-income ratios above six-times annual earnings, particularly among investors and younger homeowners.

This level of indebtedness is regarded as ‘high risk’ and likely to be subject to Bank and regulatory reform in the coming months. In the last week, we have seen feedback from the International Monetary Fund, urging Australia to tighten lending standards; Senior Bank Chief Executives express concern over the dramatic rise in property prices as did National Treasurer Josh Frydenberg (Ironically, Frydenberg’s comments come 12-months after proposing repeals of responsible lending laws). Only today, as I write this article, APRA, the market regulator has confirmed its intention to release lending restrictions within two months. In terms of what this could look like, we could expect to see limits on debt-to-income ratios; or banks increasing the serviceability buffers when reviewing applications.

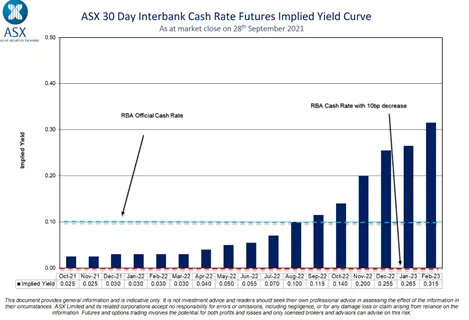

In addition to new lending restrictions, there is another risk to property prices – interest rates. Rates are at record lows and surely must begin to rise at some point. In our view, it’s not a question of if, but when. Regarding when, the Reserve Bank Governor Philip Lowe has suggested that this won’t be until 2024. Yet when we look in the futures market, (used by investors to speculate on expected cash rate changes), cash rates are priced to increase from the current 0.25% to 3.15% by February 2023. Using the average annual bank spread to their funding costs, this implies borrowing costs could be at about 6.15% by 2023.[2]

It is also worth noting that banks do not source all funding locally. They source funding where it is cheaper and available, including offshore, particularly their wholesale, longer-term debt. Therefore, irrespective of the RBA increasing rates; what global central banks and debt markets do can also cause increases to the cost of capital locally. The Bank of England indicated it may begin raising rates this year; Norway the first developed market has recently raised rates; New Zealand just raised the official cash rate to 0.50% and many central banks intend to reduce their bond-buying programs by November this year. As global debt costs begin to rise; Australian credit costs will also likely rise, directly, or indirectly.

When we reflect on property returns, many will compare their starting cost, add on any improvements made and compare it to the sale price. Yet, there are other costs associated with property. The average agent commission is 2.70% in Queensland and 2.10% in NSW (Source: Open agent), typically excluding photography costs and additional marketing costs. Then there is the additional cost of stamp or transfer duty payable within 3-months of a property purchase unless buying off the plan. For a $2.5M property in NSW, you would be paying more than $122,000 in transfer duty on a property purchase. In Queensland, slightly higher at approximately $124,000. Add on $2,000.00 for the purchase and sale of that property in conveyancing fees; and as a rule of thumb, maintenance costs of ~1% of the property value per annum including council rates.

As an example, on a principal place of residence, consider the below tables:

From an increase in the value (the notional selling price) of a property we imply a gain – being the amount above the purchase price. This is the gross return. What this table shows, is that given buying, holding and selling costs, when allowing for an average growth rate of 6.50% each year in property prices (in line with the last 25-year average)[3]; the net compound rate of return is just 2.60% per annum on an owner-occupied property where interest is not a tax-deductible expense. Even if the property had no debt, the net compound return is still only 4.05% per annum.

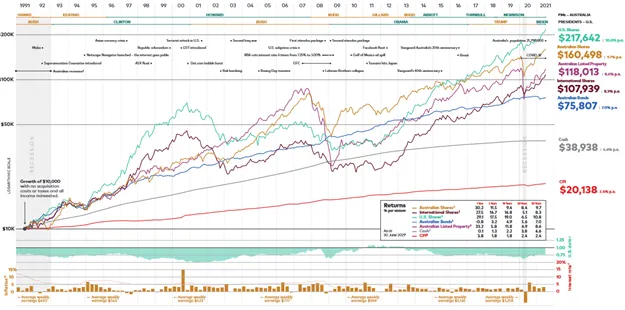

Whilst the current property price growth run has been well above the long-term average used above, the point here is that we do not believe the current trend is sustainable and, taking a longer term view, the net return from property investments is quite different to the seemingly attractive headline (gross) number. For perspective, compare our analysis above to listed markets:

Note the above returns are at an index level. Even if you subtract advice or other costs to these numbers of up to 2.00%; all assets except cash, still come out on top of property. Noting that residential property can also attract tax concessions (no CGT), even comparing the above figures net of tax; all still come out above property historical returns, except for Bonds and Cash.

As a country, we have an over-reliance on property when it comes to pursuing wealth. This carries concentration risks, relative to a diversified investment portfolio. This is especially the case if investors are highly geared. With interest rates currently at record lows, and having reduced over the past decade, borrowing (rather than wage growth) has increased dramatically, driving up residential house prices in that time. We are now at an inflection point where the opposite is true. Central banks will begin tapering bond-buying programs, and interest rates will rise from current levels. Banks are reviewing lending policy to tighten credit availability, which will reduce credit availability. Similarly, global funding costs are likely to increase, which may lift local credit costs and rates. Finally, long-term net property growth rates are lower than many listed investment returns.

Everyone needs a home; but perhaps it’s worth revisiting if property should house most of your wealth.

Until next time,

Ryan

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

The information in this podcast series is for general financial educational purposes only, should not be considered financial advice and is only intended for wholesale clients. That means the information does not consider your objectives, financial situation or needs. You should consider if the information is appropriate for you and your needs. You should always consult your trusted licensed professional adviser before making any investment decision.

Emanuel Whybourne & Loehr Pty Ltd (ACN 643 542 590) is a Corporate Authorised Representative of EWL PRIVATE WEALTH PTY LTD (ABN: 92 657 938 102/AFS Licence 540185).Unless expressly stated otherwise, any advice included in this email is general advice only and has been prepared without considering your investment objectives or financial situation.

There has been an increase in the number and sophistication of criminal cyber fraud attempts. Please telephone your contact person at our office (on a separately verified number) if you are concerned about the authenticity of any communication you receive from us. It is especially important that you do so to verify details recorded in any electronic communication (text or email) from us requesting that you pay, transfer or deposit money, including changes to bank account details. We will never contact you by electronic communication alone to tell you of a change to your payment details.

This email transmission including any attachments is only intended for the addressees and may contain confidential information. We do not represent or warrant that the integrity of this email transmission has been maintained. If you have received this email transmission in error, please immediately advise the sender by return email and then delete the email transmission and any copies of it from your system. Our privacy policy sets out how we handle personal information and can be obtained from our website.

.webp)

NewsLetter

Free Download